rhode island tax table 2021

Pay Period 06 2021. Other Rhode Island Corporate Income Tax Forms.

Success Stories Rhode Island Small Business Development Center

We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government.

. Forms may also be obtained by calling our forms line at 401 574-8970 by visiting our first-floor lobby at One Capitol Hill Providence RI or by emailing our forms request address at TaxFormstaxrigov. Details on how to only prepare and print a Rhode Island 2021 Tax Return. Rhode Island W-2 and 1099 Information and Schedule E - Exemption Schedule PDF file about 5 mb megabytes.

Rhode Island State Income Tax Forms for Tax Year 2021 Jan. 2022 Filing Season FAQs - February 1 2022. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. No action on the part of the employee or the personnel office is necessary. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax.

DO NOT use to figure your Rhode Island tax. Ad Compare Your 2022 Tax Bracket vs. Masks are required when visiting Divisions office.

More about the Rhode Island Tax Tables Individual Income Tax TY 2021. RI-1040 can be eFiled or a paper copy can be filed via mail. Marginal tax rate 633.

More about the Rhode Island Tax Tables. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. More about the Rhode Island Tax Tables.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. You can download or print current or.

Rhode Island Single Tax BracketsTY 2021 - 2022. The state sales tax rate in Rhode Island is 7 but. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

The current tax forms and tables should be consulted for the. Find your income exemptions. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Read the summary of the latest tax changes. Detailed Rhode Island state income tax rates and brackets are available on this page. The Rhode Island tax rate is unchanged from last year however the income tax brackets increased due to the annual.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Your 2021 Tax Bracket To See Whats Been Adjusted.

These back taxes forms can not longer be e-Filed. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. For those earning more than.

More about the Rhode Island Form 1040 Individual Income Tax Tax Return TY 2021 Form RI-1040 is the general income tax return for Rhode Island residents. Learn More About The Adjustments To Income Tax Brackets In 2022 vs. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599.

This form is for income earned in tax year 2021 with tax returns due in April 2022. The annualized wage threshold where the annual exemption amount is eliminated has changed from 231500 to 234750. 2022 Rhode Island Sales Tax Table.

You will need to pay 6 of the first 7000 of taxable income for each employee per year which makes your maximum FUTA tax per employee per year 420Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 making your FUTA tax rate effectively 06. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Latest Tax News.

The state income tax table can be found inside the Rhode Island 1040 instructions booklet. Find your pretax deductions including 401K flexible account contributions. The state income tax table can be found inside the Rhode Island 1040 instructions booklet.

The Rhode Island Department of Revenue is responsible for. RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated for tax year 2021.

Suburbs 101 is an insiders guide to suburban Living. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. Rhode Island Income Tax Forms.

Find your gross income. The income tax wage table has changed. More about the Rhode Island Tax Tables.

This form is for income earned in tax year 2021 with tax returns due in April 2022. The state sales tax rate in Rhode Island is 7 but you can customize this table as. Below are forms for prior Tax Years starting with 2020.

Rhode Island Division of Taxation. 2022 Rhode Island Sales Tax Table. Assessment Flyer 2021 Tax Rates.

FY 2021 Rhode Island Tax Rates by Class of Property. One Capitol Hill Providence RI 02908. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

The income tax is progressive tax with rates ranging from 375 up to 599. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. 2022 Rhode Island Sales Tax Table.

The income tax withholding for the State of Rhode Island includes the following changes. BARRINGTON 2090 2090 2090 3500 BRISTOL 1407 1407 1407 1735 BURRILLVILLE 1601 1601 1601 3500 CENTRAL FALLS 8 2369 3795 6993 3500 CHARLESTOWN 2 823 823 823 1308 COVENTRY 2 7 1897 2287 1897 1875 CRANSTON. The income tax wage table has changed.

PPP loan forgiveness - forms FAQs guidance. The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. How Marginal Tax Brackets Work.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. MUNICIPALITY NOTES RRE COMM PP MV. RI-1040 Resident Return Instructions 2021 Tax Year 2021 RI-1040 Resident Instructions PDF file less than 1 mb megabytes.

State of Rhode Island Division of Municipal Finance Department of Revenue. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Find your pretax deductions including 401K flexible account contributions.

Single Tax Brackets. If youre married filing taxes jointly theres a tax rate of 375 from 0 to 66200. East Providence RI 02914 401 435-7500.

Rhode Island College Official Bookstore

Historical Rhode Island Tax Policy Information Ballotpedia

Ri Dhs Rihumanservices Twitter

Rhode Island Schools With Covid 19 Wpri Com

Where S My Refund Rhode Island H R Block

Ri Food Bank Status Report On Hunger Rhode Island Community Food Bank

Rhodeislandtax Rhodeislandtax Twitter

Nursing Licensing Department Of Health

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Rhode Island Income Tax Brackets 2020

Covid 19 Information Ri Division Of Taxation

Rhode Island State Tax Information Support

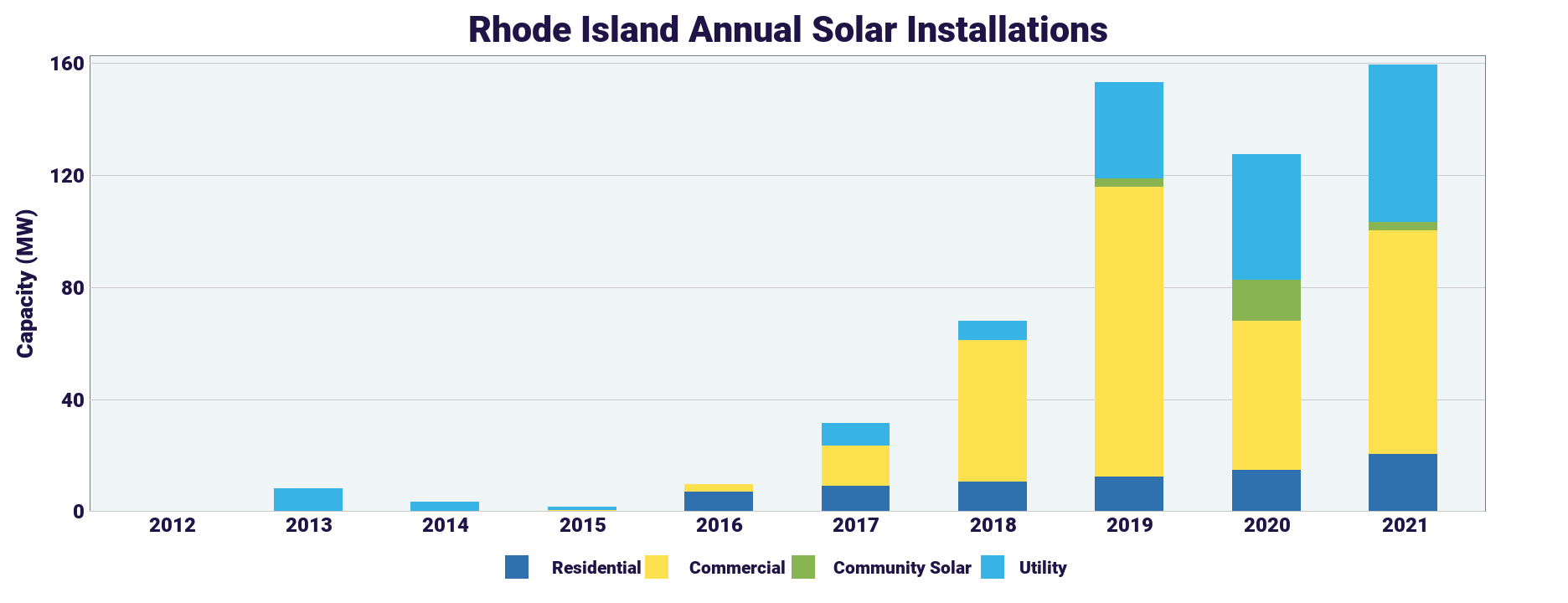

The Road To 100 Renewable Electricity By 2030 In Rhode Island Brattle

Ri Food Bank Status Report On Hunger Rhode Island Community Food Bank